Corporate Debt Issuance Success Stories

Did you know that corporate debt can be a powerful tool for financial success? Despite the negative connotations often associated with debt, many successful companies have strategically used debt financing to fuel their growth and achieve remarkable results. In this article, we will explore real-world corporate debt issuance success stories, providing case studies and examples of companies that have effectively leveraged debt to their advantage. These success stories will not only inspire and inform, but also shed light on the best practices and strategies for successful debt financing.

Key Takeaways:

- Corporate debt can be a valuable resource for companies seeking financial growth.

- Understanding the difference between good debt and bad debt is crucial.

- Companies like Uber, Airbnb, and Whole Foods have successfully utilized debt financing to drive their growth.

- Approaching debt strategically and responsibly is essential for maximizing the benefits of debt financing.

- Debt can be a valuable tool for subcontractors in managing cash flow and securing material financing.

The Importance of Distinguishing Good Debt vs. Bad Debt

When it comes to debt, it’s essential for business owners to understand the difference between good debt and bad debt. By making this distinction, companies can make informed decisions about debt financing and effectively leverage it to achieve their financial goals. Let’s explore the significance of distinguishing between these two types of debt and the impact it can have on business growth and success.

The Concept of Good Debt

Good debt refers to money borrowed by business owners to invest in assets or activities that contribute to the growth and development of their companies. Unlike bad debt, which can lead to financial difficulties, good debt is strategically sought out and carefully managed. When considering taking on good debt, business owners consider factors such as interest rates, repayment terms, and the potential for positive returns on investment.

Good debt can be a valuable tool for business expansion. By borrowing funds to invest in assets like machinery, technology, or real estate, companies can enhance their operational efficiency, productivity, and competitiveness. This type of debt can also alleviate strain on cash flow, allowing businesses to allocate funds towards other critical areas such as marketing, research and development, or talent acquisition.

The Pitfalls of Bad Debt

Bad debt, on the other hand, includes loans and credit cards taken out without a feasible plan for repayment. These debts typically come with high-interest rates and can quickly become unmanageable, leading to financial distress and negatively impacting the company’s overall financial health.

Business owners need to exercise caution when considering bad debt and ensure they have a clear and realistic repayment plan in place before borrowing. Taking on bad debt without a viable strategy can strain cash flow, limit growth opportunities, and hamper the company’s ability to meet its financial obligations.

The Value of Distinguishing Good Debt vs. Bad Debt

By distinguishing between good debt and bad debt, businesses can develop effective debt management strategies that align with their financial goals and growth initiatives.

“Good debt can be a catalyst for business growth, while bad debt can act as a hindrance. Understanding the distinction and employing debt financing strategies wisely can help businesses leverage debt as a valuable resource.”

When businesses prioritize good debt, they can strategically utilize borrowed funds to invest in growth opportunities, improve operational efficiency, and strengthen their competitive position. By carefully managing debt and making informed decisions about borrowing, companies can maximize the benefits of debt financing.

Creating a financial plan that takes into account debt repayment, interest rates, and the potential for returns on investment is crucial. This approach ensures that businesses can optimize their debt financing strategies, minimize financial risks, and achieve their long-term financial goals.

In summary, distinguishing between good debt and bad debt is vital for business owners seeking to leverage debt as a tool for growth. By seeking out good debt, prioritizing debt management, and developing strategic debt financing strategies, companies can navigate the complexities of debt financing and drive their financial success.

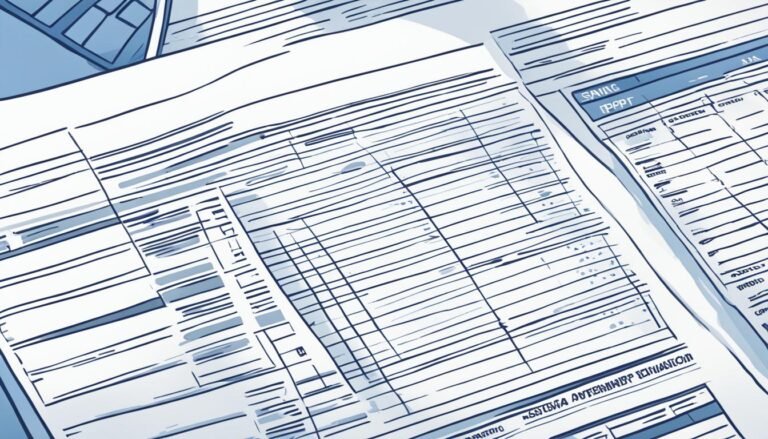

| Good Debt | Bad Debt |

|---|---|

| Invests in assets or activities that contribute to business growth | Taken out without a feasible plan for repayment |

| Strategically sought out with careful consideration of interest rates and repayment terms | Comes with high-interest rates and can quickly become unmanageable |

| Alleviates strain on cash flow and supports business expansion | Strains cash flow and hampers growth opportunities |

Success Story 1: Uber’s Strategic Debt Utilization

Uber, the rideshare giant valued at $66.6 billion, has demonstrated a strategic approach to debt utilization. They recently raised a $2 billion leveraged loan, choosing debt as a cheaper source of funding compared to equity investments. This decision helped them maintain control over the company’s ownership while improving cash flow. Despite the significant figures involved, Uber’s debt story highlights the potential benefits of taking on good debt to alleviate cash flow strain and drive financial success.

Success Story 2: Airbnb’s Debt Financing for Growth

Airbnb, the world’s highest-valued short-term rental marketplace, has boldly utilized debt as a resource to fuel its growth. In the early days of the company, founders Brian Chesky and Joe Gebbia racked up significant credit card debt to finance the company’s initial efforts, a testament to their entrepreneurial spirit and determination.

In 2020, Airbnb faced unprecedented challenges posed by the global pandemic, which severely impacted the travel industry. Despite this adversity, the company demonstrated its ability to adapt by raising $1 billion in debt financing. This strategic decision allowed Airbnb to navigate the crisis and continue operating, maintaining a positive cash flow even when faced with a net loss. By leveraging debt as a financial tool, Airbnb showcased its resilience and positioned itself for further growth.

Debt has played a crucial role in Airbnb’s cash flow management, providing the necessary resources to sustain and expand its operations. It exemplifies how well-planned and successful debt utilization in a startup can be instrumental in overcoming financial challenges and driving growth.

By effectively managing debt, Airbnb has demonstrated that leveraging borrowed funds can be a strategic choice for startups, allowing them to overcome hurdles and thrive in a competitive market. This success story serves as an inspiration for aspiring entrepreneurs, showcasing the potential of debt as a resource for financial success and sustainable growth.

Success Story 3: Whole Foods’ Unique Debt Story

Whole Foods, the renowned grocery giant, had an interesting debt story surrounding its acquisition by Amazon. While Amazon had sufficient cash to buy the grocery chain outright, it decided to borrow money instead. This strategic choice allowed Amazon to take advantage of low interest rates and protect its cash reserves for other purposes. Whole Foods’ debt story highlights the benefits of using debt strategically, even for successful companies with significant resources. It showcases how debt can be leveraged to make smart financial decisions and support long-term growth.

The Value of Debt for Business Growth

The success stories of Uber, Airbnb, and Whole Foods provide valuable insights into the value of debt for business growth. Debt financing can provide access to funds that support various aspects of a company’s growth, from startup costs to working capital. By strategically managing debt, businesses can achieve a healthy debt-to-equity ratio and leverage borrowed funds to expand operations, invest in new opportunities, and drive financial success.

“Debt is a powerful tool that can fuel growth and unlock new possibilities for businesses.”

One of the key benefits of debt financing is the ability to access capital quickly. Instead of waiting for organic growth or relying solely on equity investments, debt allows companies to seize opportunities and make immediate progress. This speed can be particularly crucial in industries with rapid innovation and evolving market dynamics.

Moreover, debt financing provides businesses with flexibility and control over their growth initiatives. Unlike equity financing, which often involves dilution of ownership and decision-making power, debt allows businesses to maintain control over their operations. Debt obligations can be structured and planned, giving companies more autonomy in managing their growth trajectory.

Another advantage of borrowing is the potential tax benefits. In many jurisdictions, interest payments on corporate debt are tax-deductible, effectively reducing the cost of borrowing. This tax advantage can further enhance the financial viability of debt financing and make it a more attractive choice for businesses seeking growth.

The Debt-to-Equity Ratio and its Significance

One important metric to consider when utilizing debt for growth is the debt-to-equity ratio. This ratio measures the proportion of a company’s financing that comes from debt compared to equity. A high debt-to-equity ratio indicates that a company relies heavily on borrowed funds, which can have both advantages and disadvantages.

A high debt-to-equity ratio may indicate that a company is taking on significant debt to fuel its growth ambitions. While this can increase the financial risk, it also implies that the company is leveraging debt to expand its operations and invest in future opportunities. Careful management of debt can mitigate this risk and ensure that borrowed funds are used strategically to drive growth.

Leveraging Debt for Expansion and Investment

By leveraging debt effectively, businesses can expand their operations, enter new markets, and invest in research and development. For example, debt financing can be used to acquire new assets, such as machinery or real estate, that are essential for scaling up production or expanding into new territories.

| Advantages of Borrowing for Business Growth | Examples |

|---|---|

| Access to immediate capital | Uber’s $2 billion leveraged loan |

| Maintaining control over company ownership | Airbnb’s debt financing for pandemic challenges |

| Tax benefits through interest deductibility | Debt financing decision in Amazon’s acquisition of Whole Foods |

Debt financing also enables businesses to invest in research and development, which is crucial for staying competitive in rapidly evolving industries. By borrowing funds, companies can allocate resources to innovation, product development, and technological advancements that drive long-term growth and market relevance.

Overall, debt financing offers a range of advantages for business growth. From providing quick access to capital and maintaining control over ownership to benefiting from tax advantages, businesses can leverage debt strategically to fuel expansion and drive financial success.

Remember, debt financing should be approached with careful planning and consideration. It’s important for businesses to assess their growth initiatives, develop a comprehensive financial plan, and determine the optimal debt-to-equity ratio for their specific needs. By understanding the value of debt for business growth and implementing effective debt management strategies, companies can unlock their full potential and achieve remarkable financial success.

Overcoming Apprehensions and Approaching Debt Strategically

Many business owners have apprehensions about taking on debt, often driven by personal finance experiences and societal views on debt. However, it’s important to understand the fundamental differences between personal and business debt. Business debt, when used strategically and responsibly, can be a powerful tool for growth and financial success. By approaching debt strategically, businesses can create a financial plan, assess growth initiatives, and develop a budget that factors in expenses, cash flow, and debt repayment. Responsible debt usage, supported by thoughtful planning, can mitigate risks and maximize the benefits of debt financing.

To overcome debt apprehension and utilize debt effectively, businesses should consider the following best practices:

- Evaluate Financial Position: Conduct a thorough analysis of your company’s financial situation, including cash flow, assets, and liabilities. This assessment will help determine how much debt your business can comfortably take on and manage.

- Create a Financial Plan: Develop a comprehensive financial plan that outlines your business goals, growth strategies, and debt management strategies. This plan should include a realistic budget that accounts for debt repayment alongside other expenses.

- Identify Growth Initiatives: Identify specific projects or initiatives that require additional funding and assess their potential returns. By aligning debt with growth opportunities, you can ensure that borrowed funds are used strategically to generate revenue and enhance profitability.

- Research Debt Financing Options: Explore different debt financing options such as loans, lines of credit, or bonds. Compare interest rates, terms, and repayment schedules to find the most suitable option for your business.

- Establish Responsible Debt Usage Guidelines: Implement guidelines and policies for debt usage within your organization. Clearly define how debt should be used and monitored, ensuring that it aligns with your growth objectives and has appropriate risk management measures in place.

By adhering to these debt financing best practices, businesses can overcome apprehensions, make informed decisions, and leverage debt as a strategic tool for growth and financial success.

Embracing Debt as a Subcontractor for Material Financing

Subcontractors, like other businesses, can benefit from strategic debt usage, particularly when it comes to material financing. Many subcontractors face cash flow challenges when supplier invoices are due, while pay apps take time to process. By opting for material financing solutions, subcontractors can purchase necessary materials upfront, secure cash discounts, and have an extended period to repay the borrowed amount. This approach alleviates cash flow strain and ensures timely completion of projects. Debt solutions tailored for subcontractors can be a valuable resource for managing cash flow and fueling growth.

When it comes to material purchase financing, subcontractors often encounter obstacles that hinder their cash flow management. Supplier invoices may be due before payments from clients are received, creating a financial strain. Additionally, using pay apps can result in delays in receiving funds. To overcome these challenges, subcontractors can turn to specialized material financing solutions like Billd.

Billd offers subcontractor debt financing specifically designed to address the unique needs of the construction industry. With Billd, subcontractors can purchase materials upfront and defer payment until after the project is completed. This arrangement provides immediate access to the necessary materials without draining cash reserves or relying on slow-paying clients.

One significant advantage of using material financing solutions like Billd is the ability to secure cash discounts from suppliers. By paying upfront, subcontractors can negotiate better pricing, reducing the overall cost of materials. These savings can significantly contribute to the profitability of projects and enhance the competitive advantage of subcontractors.

The Benefits of Subcontractor Debt Financing:

- Improved cash flow management: Material financing allows subcontractors to align their cash outflows with project completion milestones, preventing cash flow strain during construction.

- Timely completion of projects: By having immediate access to materials, subcontractors can avoid delays and ensure project schedules are met.

- Opportunity to negotiate better pricing: Paying upfront provides leverage for subcontractors to negotiate favorable pricing and discounts from suppliers, enhancing profitability.

- Preservation of cash reserves: Material financing allows subcontractors to preserve their cash reserves for other critical business needs, such as payroll, overhead expenses, and unexpected emergencies.

- Competitive advantage: By utilizing material financing solutions, subcontractors can position themselves as reliable partners, attracting more clients and enhancing their reputation in the industry.

Case studies have demonstrated the effectiveness of subcontractor debt financing in driving sustainable growth and success. Subcontractors who embrace this strategic approach can overcome cash flow challenges, secure necessary materials on time, and ultimately focus on delivering quality projects.

Billd has been a game-changer for our business. With their material financing solutions, we can now tackle larger projects without worrying about cash flow constraints or delayed payments from clients. It’s revolutionized the way we operate and has contributed significantly to our growth and profitability.

Comparison of Subcontractor Debt Financing Solutions

| Debt Solutions | Features | Benefits |

|---|---|---|

| Billd |

|

|

| Other Financing Options |

|

|

When selecting a material financing solution, subcontractors should carefully evaluate their options and choose one that aligns with their specific needs. By embracing debt as a subcontractor, businesses can overcome cash flow challenges, secure timely access to materials, and position themselves for long-term success in the construction industry.

Conclusion

The success stories of companies like Uber, Airbnb, and Whole Foods highlight the immense potential of using corporate debt strategically to achieve financial success. These companies have leveraged debt as a growth catalyst, demonstrating the value of debt financing in expanding operations and driving long-term profitability. To replicate their achievements, businesses must carefully distinguish between good and bad debt, develop a strategic approach to debt management, and create a financial plan aligned with their growth initiatives.

By learning from these success stories, businesses can gain valuable insights into the best practices of debt financing. They can unlock the full potential of debt as a resource for growth and overcome apprehensions by understanding that debt, when used strategically, can serve as a valuable tool. Approaching debt with care and responsibility allows businesses to secure the necessary funds to navigate challenges, invest in new opportunities, and fuel expansion, all while maintaining a healthy debt-to-equity ratio.

Overall, the key takeaway from these corporate debt issuance success stories is that leveraging debt for financial success requires a thoughtful and strategic approach. By embracing debt as a resource and implementing sound debt management practices, businesses can unlock their full potential and achieve remarkable financial growth.