Capital: Definition, How Its Used, Structure, and Types in Business

Capital in business refers to assets and resources that enhance owners' value. It entails utilizing personal savings, angel investors, and corporate funding for maximum returns. Types include debt financing, equity financing, and working capital for daily operations. Capital structure involves equity distribution and debt management to maintain financial health. Strategically using capital drives growth, efficiency, and innovation, aligning with long-term goals. Understanding key metrics aids in sustainable financial management. For a detailed insight into the various nuances of capital in business, explore its definition, sources, types, structure, and utilization strategies.

Key Takeaways

- Capital encompasses assets adding value, sourced from personal savings, angel investors, or corporations.

- Types of capital include debt, equity, and working capital, optimizing returns across assets.

- Capital structure balances equity and debt for financial health and sustainability.

- Capital drives operational efficiency, growth, innovation, and market expansion.

- Capital allocation, crucial for financial success, aligns with long-term objectives and shareholder value.

Definition of Capital

In the domain of business, the term 'capital' encompasses assets or resources that bestow value or advantage upon the owners. Sources of funding for capital include personal savings, angel investors, and corporations.

Capital allocation is the strategic distribution of resources to different avenues within a business to optimize returns. Companies utilize capital to fund various activities such as investments in labor, building expansions, or acquiring new technologies. It is essential for businesses to carefully manage their capital allocation to guarantee efficient utilization and maximize profitability.

Understanding the sources of funding and effectively allocating capital are fundamental aspects of financial management that contribute to the overall success and sustainability of a business.

Sources of Capital

Efficient capital sourcing is a fundamental component of strategic financial management within businesses. When considering funding options and investor relations, capital acquisition and financial planning are essential for sustainable growth. Companies have various sources of capital, including personal savings, angel investors, and corporate investments. Developing strong investor relations can open doors to diverse funding options, aiding in capital acquisition strategies. Financial planning plays a pivotal role in determining the appropriate mix of debt and equity financing. By carefully analyzing the cost of capital and potential returns, businesses can make informed decisions regarding their capital structure. A balanced approach to capital acquisition is vital for long-term success and financial stability.

| Sources of Capital | Description | Examples |

|---|---|---|

| Personal Savings | Funds contributed by the business owner from personal income or savings. | Entrepreneur's savings |

| Angel Investors | Individuals who provide capital for startups in exchange for ownership equity. | Silicon Valley angel investor |

| Corporate Investments | Capital sourced from established companies investing in or acquiring other businesses. | Google's investment in a tech startup |

Types of Capital in Business

When considering funding options and investor relations, understanding the various types of capital in business is imperative for strategic financial management. Capital allocation involves distributing resources efficiently across different assets to optimize returns.

Capital raising, on the other hand, focuses on acquiring funds through various means like debt financing, equity financing, or issuing corporate bonds. Debt capital is borrowed money that requires regular repayment with interest, while equity capital involves selling shares in the company to investors.

Working capital provides liquidity for daily operations, and trading capital is utilized by financial institutions for buying and selling securities. Each type of capital serves a specific purpose in facilitating business activities and growth, highlighting the importance of a well-rounded capital structure for long-term success.

Capital Structure Components

One critical aspect of financial analysis in business involves dissecting the components that make up the capital structure of a company. Equity allocation and debt management are two key components that play a significant role in shaping a company's financial framework.

Equity allocation refers to the distribution of ownership in the company among shareholders, determining who holds what percentage of the business. On the other hand, debt management involves handling the company's borrowings, ensuring timely repayments, and maintaining a healthy debt-to-equity ratio.

Striking the right balance between equity and debt is vital for the financial health and sustainability of the business, influencing decisions on fundraising, investment strategies, and overall risk management.

Use of Capital in Business

The utilization of capital in business plays an essential role in driving operational efficiency and facilitating strategic growth initiatives. Investment strategies and allocation of capital are key considerations for businesses aiming for financial growth and optimization.

Efficient use of capital can enhance productivity, support innovation, and expand market presence. Businesses often strategize their investment decisions to maximize returns while managing risks associated with capital allocation. By evaluating different investment opportunities, companies can align their capital usage with long-term objectives and financial performance targets.

Effective capital utilization is critical for sustaining operations, funding expansion projects, and generating shareholder value. Hence, businesses must carefully analyze their capital needs and deploy resources judiciously to achieve sustainable growth and competitive advantage.

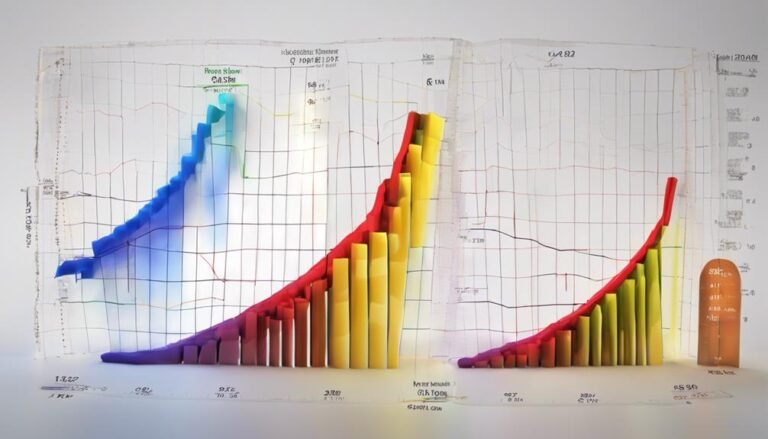

Key Metrics for Business Capital

To assess the efficiency and effectiveness of capital utilization, businesses rely on key metrics that provide insights into the financial health and performance of their capital investments.

Two crucial metrics in this regard are Return on Investment (ROI) and Cost of Capital. ROI measures the profitability of an investment relative to its cost, indicating how effectively the capital is being utilized to generate returns.

On the other hand, the Cost of Capital represents the required rate of return that a company must achieve on its investments to satisfy its investors or lenders.

Capital in Economics and Finance

How does capital play a crucial role in shaping economic and financial landscapes? Capital serves as a fundamental driver of economic growth and a cornerstone of financial markets. In economics, capital represents the assets available for spending within an economy, fostering productivity and expansion. Within financial management, capital fuels daily operations and future endeavors, encompassing assets like real estate, investments, and machinery. Sources of capital include working capital, equity capital obtained through shares, and debt capital acquired through borrowing. This blend of working capital, equity capital, debt capital, and trading capital propels both immediate operational needs and long-term investments, ultimately contributing to economic prosperity and the efficiency of financial markets.

| Capital in Economics and Finance | ||

|---|---|---|

| Key Points | Economic Growth | Financial Markets |

| Definition | Represents assets for spending | Facilitates trading and investment |

| Role | Drives productivity and expansion | Enhances market efficiency |

| Sources | Working, equity, debt capital | Stock exchanges, borrowing |

| Impact | Fuels economic growth | Influences market dynamics |

Conclusion

To sum up, capital serves as a fundamental pillar in business operations, encompassing diverse resources that contribute to financial stability and growth. Through various types such as working, equity, debt, and trading capital, businesses leverage these assets to drive strategic decision-making and operational functions.

The analysis of capital structure provides insights into a company's financial health and resource allocation strategies, highlighting the critical role of capital in the dynamic landscape of business enterprises.