Using Financial Planning Software: Maximizing Efficiency and Effectiveness

In the area of modern financial management, utilizing sophisticated software has become increasingly crucial for professionals seeking to streamline their processes and enhance decision-making capabilities.

Financial planning software offers a plethora of benefits, ranging from simplifying complex calculations to providing in-depth analysis of financial data. However, the true power of these tools lies not just in their features but in how efficiently and effectively they are utilized.

By delving into the world of financial planning software, professionals can access a world of possibilities that can revolutionize the way they approach financial management. Stay tuned to discover how maximizing efficiency and effectiveness through software can pave the way for sustainable growth and success in the financial landscape.

Key Takeaways

- Improved accuracy and automation streamline financial tasks.

- Integration options provide a holistic view for informed decisions.

- Advanced analytical tools enhance decision-making processes.

- Tailoring software and proactive evaluation maximize ROI.

Benefits of Financial Planning Software

Financial planning software offers numerous advantages for individuals and businesses seeking to enhance their financial management strategies. One key benefit is the improved accuracy it provides in financial calculations and projections. By automating complex calculations and eliminating human error, this software guarantees that financial data is precise, reducing the risk of mistakes in budgeting, forecasting, and investment analysis.

Additionally, financial planning software saves significant time for users. Tasks that would otherwise be labor-intensive and time-consuming, such as data entry, report generation, and scenario analysis, can be completed efficiently with the help of this software. By streamlining these processes, individuals and businesses can allocate their time more effectively to strategic decision-making and planning for the future.

Features for Streamlined Financial Management

Efficient financial management relies on utilizing software with features that streamline processes and enhance decision-making capabilities. Automation advantages play a critical role in simplifying financial management tasks. Through automation, routine processes such as data entry, transaction categorization, and report generation can be performed efficiently, saving time and reducing the potential for errors. By automating these tasks, financial planners can focus more on analysis and strategic decision-making rather than manual data processing.

Integration options are another key feature for streamlined financial management. Financial planning software that offers seamless integration with other tools and platforms, such as accounting software, banking systems, and investment management platforms, enables a holistic view of an individual's or organization's financial situation. This integration allows for real-time data syncing, eliminating the need for manual data transfers and ensuring that all financial information is up to date and accurate across different systems.

To summarize, the automation advantages and integration options provided by financial planning software are essential for maximizing efficiency and effectiveness in financial management processes.

Tips for Efficient Financial Analysis

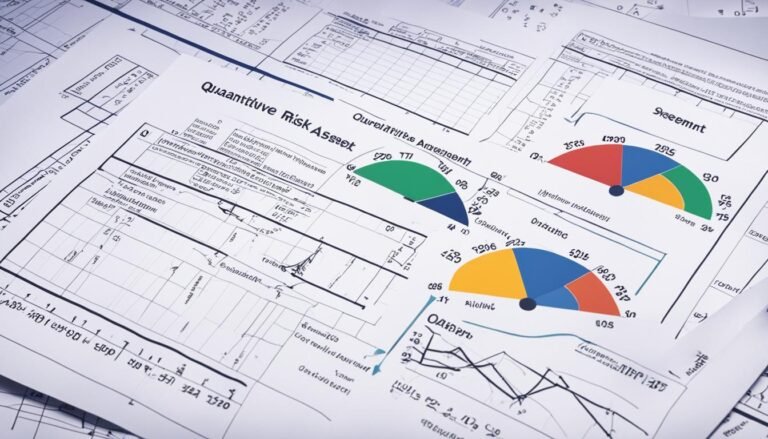

Utilizing advanced analytical tools and industry benchmarks can greatly enhance the accuracy and depth of financial analysis. When conducting financial analysis using software, incorporating data visualization techniques can simplify complex data sets and aid in identifying trends and patterns. Visual representations such as graphs or charts can make it easier to interpret financial information quickly and make informed decisions.

Effective budget tracking is another essential aspect of efficient financial analysis. Financial planning software allows for real-time tracking of expenses against budgeted amounts, enabling users to proactively manage cash flow and identify areas where adjustments may be necessary. By regularly monitoring budget variances, financial analysts can promptly address any discrepancies and make certain that financial goals are on track.

Enhancing Decision-Making With Software Tools

To optimize decision-making processes, incorporating cutting-edge software tools can provide invaluable insights and strategic advantages in managing intricate financial landscapes.

Data visualization plays an essential role in enhancing decision-making by presenting complex data in a visual format that is easy to interpret. Through interactive charts, graphs, and dashboards, financial professionals can quickly identify trends, patterns, and outliers, facilitating informed decision-making.

Additionally, predictive modeling enables users to forecast future outcomes based on historical data, scenario analysis, and statistical algorithms. By leveraging predictive modeling tools, practitioners can assess various what-if scenarios, evaluate potential risks, and make proactive decisions to mitigate uncertainties.

Incorporating software tools that offer advanced data visualization and predictive modeling capabilities empowers financial professionals to make data-driven decisions with confidence. These tools not only streamline the decision-making process but also enhance accuracy and efficiency in maneuvering dynamic financial environments.

Ultimately, leveraging these software tools can lead to better strategic planning, improved risk management, and enhanced performance in achieving financial goals.

Maximizing ROI With Financial Software

Maximizing return on investment through the strategic implementation of financial software solutions is integral to enhancing operational efficiency and driving sustainable growth in today's competitive financial landscape. When aiming to maximize ROI with financial software, several key aspects should be considered:

- Software customization: Tailoring the financial software to meet specific organizational needs and workflows can greatly boost efficiency and effectiveness.

- Implementation challenges: Addressing implementation challenges proactively, such as data migration issues or staff training needs, is important for a successful integration of financial software.

- Continuous monitoring and evaluation: Regularly evaluating the software's performance against predefined metrics allows for timely adjustments and improvements, ensuring best ROI.

- Integration with existing systems: Seamless integration of the financial software with existing tools and platforms can streamline processes and enhance overall operational efficiency.

Conclusion

To sum up, utilizing financial planning software can greatly enhance efficiency and effectiveness in managing finances. By leveraging the benefits and features of these tools, individuals and businesses can streamline financial management, improve analysis, and make informed decisions.

The ability to maximize ROI with software tools makes them invaluable in today's fast-paced financial landscape. As the saying goes, 'Time is money,' and investing in financial software can save both time and money in the long run.