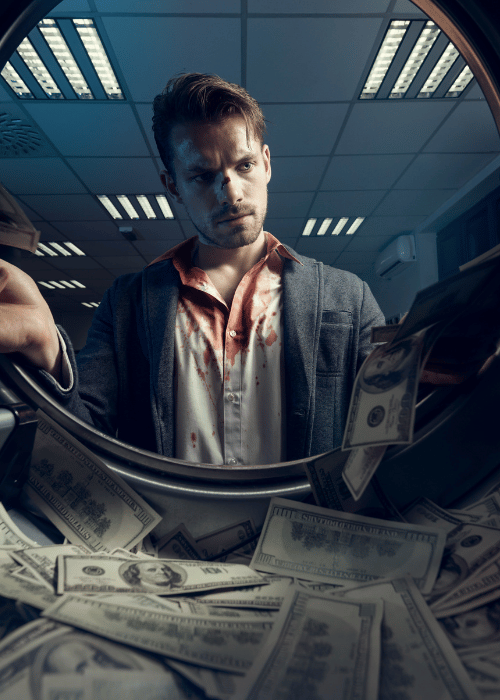

Anti-Money Laundering

Original price was: $100.00.$49.00Current price is: $49.00.

🌟🌟🌟🌟🌟 “The AML course was incredibly informative. The insights into KYC and due diligence have significantly improved our compliance processes.” – Samantha J., Compliance Officer

Anti-Money Laundering (AML) Course

Navigating the Complexities of AML: A Comprehensive Guide for Professionals

In an era where financial crimes are increasingly sophisticated, understanding and combating money laundering is a crucial skill for finance and compliance professionals. Our Anti-Money Laundering (AML) course is an in-depth online training program, specifically designed to provide a thorough understanding of AML principles, practices, and legislation. This self-paced course caters to the busy schedules of professionals in the banking, financial services, and legal sectors, as well as those in regulatory bodies.

Over comprehensive modules, participants will explore the intricacies of money laundering methods, the legal framework governing AML, techniques for detecting and preventing money laundering, and the roles of various regulatory agencies. The course covers a wide array of topics, from the basics of AML to advanced analytics in detecting suspicious activities. It’s ideal for those new to the field, as well as seasoned professionals seeking to update their knowledge in line with current best practices and regulations.

Learning Objectives

- Understand AML Fundamentals: Gain a deep understanding of what constitutes money laundering and its impact on the global financial system.

- Legal and Regulatory Frameworks: Learn about international and national laws and regulations pertaining to AML, including the role of key regulatory bodies.

- Detection and Prevention Strategies: Master techniques to identify suspicious financial activities and implement effective AML controls and procedures.

- Compliance and Reporting Obligations: Understand the responsibilities of financial institutions in AML compliance, including the process of filing reports.

- Emerging Trends and Challenges: Stay updated on the latest developments in AML, including the use of technology in money laundering and countering financing of terrorism.

Why This Training Matters

AML training is essential for professionals in the financial sector to ensure compliance with legal standards and protect their institutions from the risks associated with money laundering. Effective AML strategies are not only a legal requirement but also pivotal in maintaining the integrity of the financial system and preventing financial crimes.

Course Outline

Module 1: Introduction to Money Laundering

- Definition and Stages of Money Laundering

- The Impact on Financial Systems and Society

Module 2: Legal and Regulatory Framework

- International AML Standards (FATF, etc.)

- National Laws and Compliance Requirements

Module 3: Detecting Money Laundering

- Identifying Suspicious Activities

- Customer Due Diligence (CDD) and Know Your Customer (KYC) Procedures

Module 4: Reporting and Compliance

- Reporting Obligations (SARs, CTRs)

- Designing an Effective AML Compliance Program

Module 5: Advanced AML Techniques and Technologies

- Utilizing Data Analytics in AML

- Emerging Trends and Future Challenges in AML

Testimonials

- “The AML course was incredibly informative. The insights into KYC and due diligence have significantly improved our compliance processes.” – Samantha J., Compliance Officer

- “As a new entrant in the banking sector, this course provided me with a solid foundation in AML principles. The modules were comprehensive and easy to follow.” – Liam T., Bank Associate

Glossary:

1. Anti-Money Laundering (AML)

Definition: A set of procedures, laws, and regulations designed to prevent criminals from disguising illegally obtained funds as legitimate income.

2. Money Laundering

Definition: The illegal process of making large amounts of money generated by criminal activity appear to have come from a legitimate source.

3. Financial Action Task Force (FATF)

Definition: An intergovernmental organization that designs and promotes policies and standards for combating money laundering, terrorist financing, and other related threats to the integrity of the international financial system.

4. Suspicious Activity Report (SAR)

Definition: A document that financial institutions must file with the Financial Crimes Enforcement Network (FinCEN) when a suspected case of money laundering or fraud is detected.

5. Customer Due Diligence (CDD)

Definition: The process whereby financial institutions gather and evaluate information about their customers to assess the risk they pose for money laundering or terrorist financing.

6. Know Your Customer (KYC)

Definition: The process used by a business, particularly in the financial sector, to verify the identity of its clients as part of anti-money laundering measures.

7. Compliance Program

Definition: A set of internal policies and procedures of a company to comply with laws, regulations, and rules, and to minimize the risk of fraud and money laundering.

8. Currency Transaction Report (CTR)

Definition: A report that U.S. financial institutions are required to file for each transaction over $10,000 in currency.

9. Terrorist Financing

Definition: The provision of funds or financial support to terrorist individuals or groups.

10. Risk Assessment

Definition: The process of identifying and evaluating the risks associated with money laundering and terrorist financing that an organization is exposed to.

11. Financial Intelligence Unit (FIU)

Definition: A central national agency responsible for receiving, analyzing, and transmitting disclosures on suspicious transactions to the relevant authorities.

12. Enhanced Due Diligence (EDD)

Definition: Additional information collection and monitoring procedures for high-risk customers to provide a higher level of scrutiny and decrease the risk of money laundering.

13. Politically Exposed Persons (PEP)

Definition: Individuals who are or have been entrusted with a prominent public function, and therefore, are higher risk for involvement in bribery and corruption by virtue of their position and the influence that they may hold.

14. Transaction Monitoring

Definition: The practice of monitoring customer transactions, including assessing historical/current customer information and interactions to provide a complete picture of customer activity.

15. Bank Secrecy Act (BSA)

Definition: The United States’ primary anti-money laundering law, which requires financial institutions to assist government agencies in detecting and preventing money laundering.